Dubai Property Prices

Quite a few people are interested in Dubai Property Prices these days. Outside of the United Arab Emirates (UAE), of which Dubai is a member, this is predominantly driven by foreigners and ex-pats who bought property there between 2002 and 2008.

Dubai only opened its property market to freehold ownership in 2002, so there was a stampede of prospective property owners from overseas looking to invest in this new, and very unique, market.

It has to be said, a lot of the investment was driven by property investors rather than end users and there were questions about where this would lead the fledgling Dubai market. There are those that say this caused the ultimate demise of the Dubai property market (somewhere between 2008 and 2010, depending on who you listen to), but this chooses to ignore the fact that other markets such as the UK, Spain, Portugal, Ireland and the US all took a nose-dive at around the same time. It was very much a worldwide financial crisis and, restrictions in access to freely available funding brought a lot of property markets to their respective knees.

Interest in prices in the Dubai Property Market have surged since the end of 2013, following the announcement of the necessity to pay an increased Dubai Property Registration Tax by the end of June 2015. Essentially, a lot of people who put deposits on property back in the boom times had heard nothing since and suddenly got a notification to pay a tax for a property they had, in many cases, forgotten they had committed to purchase.

Nothing like such a bolt from the blue to make you sit up and take notice that a property market is still in existence. Those who put deposits on property between 2002 and 2008 for developments that looked like they may never materialise will, in the main, be very happy to know that many of the developments have now actually begun construction. Better late than never I guess.

Others, unfortunately, are not quite so enthused. Some don’t now want the properties or can’t afford to complete on them. A lot can happen in 10 to 13 years and many people’s circumstances have changed completely.

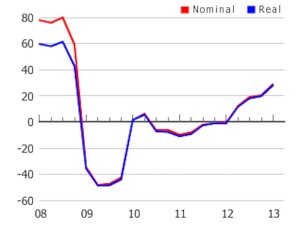

A quick summary of the Dubai property market (see graphic below) would inform you that prices peaked in 2008. Then the market rapidly showed signs of complete collapse, although the authorities didn’t admit this until sometime in 2009 (when the market had, ironically, actually started to recover somewhat). In 2012 the market started to grow rapidly, as has been the case in many other property markets, some quicker some slower.

The Dubai authorities decided to take action to cool the rapidly warming market, fearing a repeat of the 2008 crash. The introduction of the increased registration tax was one of those measures. Consequently, in late 2014 and into mid-2015 Dubai was the world’s worst performing residential property market recording losses of around 15.5% in the residential market to the end of Q2.

If you are looking to sell a property in Dubai we have a number of investors who are willing to consider most properties and are capable of making a quick decision and expiditing the transaction process – which can often be a problem in this market. If you would like to know what you can realise for your property or deposit on a property just drop a line to info@diarmaidcondon.com.