Detroit Bargains May Be a Steal – But for Whom?

Detroit Bargains May Be a Steal – But for Whom?

A colleague of mine contacted me recently in relation to returns being offered on Detroit property at a UK property show some weeks back.

I’ve always had my suspicions about these to be honest, although I’ll admit to knowing absolutely nothing about Detroit. This colleague, however, does know quite a bit about the city and its environs and he was very taken aback by what faced him at this property show.

Firstly, it’s not a particularly salubrious spot. It was in the distant halcyon days of the US car industry, but not now. In fact, if the mayor of the city, Dave Bing, is to be believed the city may be looking to file bankruptcy. In his own words “the police and firemen will be the last to be let go due to crime in Detroit.”

Anyway, quite apart from that, the returns being quoted on many of these ‘investments’ are extravagant (they generally vary from 10% to more than 20% – 22% in this particular piece – depending on who you’re listening to, probably even higher with some of them I’ve not seen). In my colleague’s fairly knowledgeable opinion these returns are on the high side to say the very least. The chances of having an empty unit are far higher than the chances of letting it in most areas, particularly ones with rock bottom prices, which are those being most heavily pushed because of these low prices.

I guess it’s all down to expectations. I remember speaking in depth with a US property investor in Rochester, upstate New York, a couple of years ago. His formula was to buy property at really low prices in working class areas, renovate or redecorate them and then let them out. Because of the low price points the clientele were unavoidably fairly street smart. He said, “it’s quite profitable, but you need to be prepared to bring your shotgun in the boot to be sure you get your rent.” Everyone to their own, but not the market for me I’m afraid.

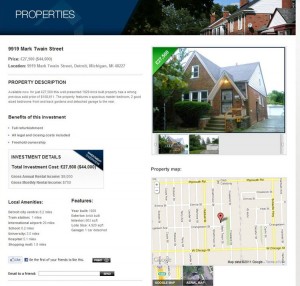

In any case, back to Detroit. To show just how much Irish, English and European investors are being suckered take the below example. This is a Detroit property being listed for sale by a UK based US Foreclosure sales company for US$44,000. A virtual steal you might say.

Until you see the following. This is the very same property promoted for sale in the USA to American buyers at $8,500, I kid you not. This is it on the Realtors.com website. It may disappear if it is sold, but it was very much still available at time of writing.

Now the UK company does say that it will be refurbishing the property to a high standard – but it would want to be. It is, in effect, upping the price of this unit by a whopping factor of more than 5. This is no doubt a very good investment, but only for this intermediary I would suggest. I doubt very much it’ll leave the ultimate purchaser in a wonderful state of financial wellbeing. If this property is for sale on in the US for US$8,500 then I would suggest that no matter what level of refurbishment you give it you’ll struggle to get more than US$20,000 for it in the short to medium term. I’m sure the intermediary would seek to debate this estimation with me, and it’s perfectly entitled to do so, but the market is seldom too far out on values and the US market currently obviously feels that this property is worth just US$8,500 – a long, long way away from US$44,000.

Now I’m not for a minute suggesting that the company (and many dozens of other US Foreclosure specialists) is doing anything illegal, it is not. In fact from what little I can glean on this particular company it’s pretty reputable, being a card carrying member of the AIPP. Like all property sales companies, it’s in the property business to make money. Despite what you may be led to believe, nobody does this for free. It is, however, very much a case of Buyer Beware. If you don’t have your homework done you’ll be taken to the cleaners in the overseas property market. It is still, and is likely to remain, an unregulated mire for the investor. You really need to be very, very careful and put a lot of effort into examining thoroughly the area into which you intend to invest your money well in advance of any purchase. Don’t expect to walk up to someone with a chequebook at a property exhibition and make a fortune out of it. You may be lucky, but in most cases you won’t be and the seller or intermediary will walk off with most of your investment in his or her pocket.

The one thing the US market has going for it is that it operates a very transparent Multiple Listing Service (MLS), which means that every realtor has access to all the listings of every other realtor in the country. It also means that you and I can just log on to Realtor.com and search for full details of any property on which we wish to find information. Unfortunately, the amount of people actually aware of this is not huge, and foreclosure sales companies don’t make its existence widely known – for obvious reasons.

My advice, for what it’s worth. If you can’t justify flying out to the US to check out this investment (or any other) either from a time or expense perspective, then go and invest in something else less risky. If it’s worth the investment then it’s worth at least the time, effort and expense of going to see where it is, what it is and what it might be with a little more investment and some work. I’d also speak to some local letting agents about the chances of letting it, they might be slightly less than you’d be led to believe by the seller.